Conventional loans are backed by private lenders, just like a financial institution, in lieu of the federal authorities and sometimes have demanding demands about credit score score and financial debt-to-profits ratios. When you've got fantastic credit history having a 20% down payment, a standard financial loan could be a terrific possibility, as it always offers reduce interest rates without non-public mortgage coverage (PMI).

If you prefer to to learn more about mortgage consultants and their job in the home obtain course of action, fill out the shape underneath and a home financial loan specialist will get to out to you.

We scour the web for reviews from effectively-identified assets. Each individual supplier is evaluated depending on the quality and quantity of their reviews, their presence on many assessment web sites, and their common minimum ranking.

Lenders that don’t publicly display their desire premiums online or work in fewer than 4 provinces or territories were not eligible for assessment.

During the number of occasions a broker does demand the borrower for their services, borrowers can assume to pay for a price involving 1 to 2 percent from the financial loan principal. Before you decide to commit to working with a broker, inquire about rate construction and what there's a chance you're liable for shelling out, if something.

Enhancing your credit rating may well support safe your mortgage in a decreased curiosity price, and should lead to a decreased every month payment on your own home.

Minimum amount 660 credit history rating. Least and most loan quantities use. Plan funding only accessible on Houses with one particular existing mortgage lien and subject to greatest personal loan-to-price ratio. Not offered in all states or territories. Other terms and limits implement. Make sure you Get in touch with us for more information.

But when You are looking to make use of substitute mortgage programs, like in industrial housing, or hoping to get a specialised personal loan program, getting a mortgage consultant in your facet could be a big assistance and enjoy main cost savings.

Go ahead confidently — When it's time to make a suggestion, you will have the confidence of figuring out you'll be able to back it up.

The level of this tax is, yet again, quite specific. Some excellent info at the tip: you can save on taxes and lower your annual tax foundation with the portion of the desire rate you’ve currently paid off!

HELOC A HELOC is usually a variable-level line of credit rating that permits you to borrow cash for the established period of time and repay them later.

How do we make sure the brokers we do the job with give a 5-star assistance? We practice them ourselves! As A part of our invite-only onboarding strategy, all brokers will have to meet our superior criteria prior to we’d even contemplate permitting them enable among our customers.

LTV means loan to value. It's a difference between the true assets worth (in accordance with the lender estimate) and the amount which a client desires to borrow.

With regards to the dimensions of your mortgage, click here This may be a considerable sum of money, and some lenders let borrowers to roll this into the overall price of the mortgage to offset a considerable upfront payment for borrowers.

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Danielle Fishel Then & Now!

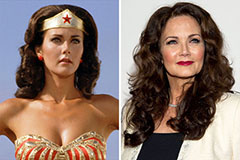

Danielle Fishel Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!